learn business mandarin

course code FM002

The "Finance Mandarin Mergers and Acquisitions M&A Course" is designed for:

Investment bankers, financial advisors, lawyers, account auditors and corporate finance specialists who provide M&A advisory services to investors and clients in China.

Learn Business Mandarin Chinese focus on M&A and Due Diligence. Chinese M&A deal-flow activities are flourishing and personal relationships are critical to success. Communication in Business Mandarin will enable your success as the deal investment banker, legal advisor, ratings agency and accountant.

Course Code FM002

M&A, Private Equity, China IPOs | Learn Business Mandarin with Legal-focus Case Study

Next step:

contact us to arrange a SWOT assessment.

course content

Course content is built on case studies of the latest China market deals. You will learn the leaders and companies active in China's IPO market.

recently added case studies

BNP HSBC fined for Korean naked short selling

case study preview >>>

Xiaohongshu IPO HK 2024

case study preview >>>

How China Private Equity Firms Apply AI & Tech

case study preview >>>

most popular case studies

TikTok Spin-off, Sequoia & General Atlantic Plan to Acquire (Trump Banned the APP in US 1 Aug 2020)

case study preview >>>

China Speeds Up New Infrastructure (part 1)

case study preview >>>

IPO Valuation: Didi & Uber Comparison

case study preview >>>

study industry leaders

马云

Mǎ Yún

Jack Ma, Chairman Alibaba

deal maker

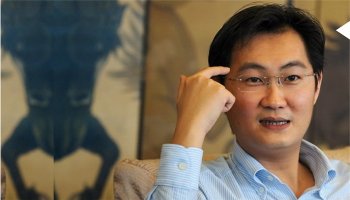

马化腾

Mǎ Huà Téng

Pony Ma, Tencent

deal maker

Finance Mandarin for Cifford Chance (Alumni)

legal advisor

Finance Mandarin for Moody's (Alumni)

ratings agency

Finance Mandarin for KPMG (Alumni)

account auditor

Finance Mandarin for GS (Alumni)

investment bank

tailored to match your Mandarin level

Learning packages to suit your mode of study and your work schedule.

Next step:

contact us to arrange a SWOT assessment.

Contact our top communication specialists now. Next step:

contact us to arrange a SWOT assessment.

Our clients are top performers at global financial institutions. Finance Mandarin alumni are leaders in asset management who capitalise on the value of person to person relationships.

I work in the field of luxury insurance and learning Chinese is very helpful in furthering my engagement with my Chinese speaking clients. As a total beginner of learning Chinese, I have been very satisfied with my excellent trainer from Finance Mandarin. more ...

Rhiannon Alban-Davies

Insurance Broker, Fine Art & Jewelry

Willis Towers Watson Hong Kong

With Vienne Lee, I have had an excellent Finance Mandarin coaching since I started working in the banking industry. The program focused on LBO and Project Finance. After few years, I reached out to her again for presentation and pitching enhancement. more ...

Steven Sze

Investment Banking Associate

JP Morgan

Next step:

contact us to arrange a SWOT assessment.

"Finance Mandarin Mergers and Acquisitions Course" is designed for your learning, with three layers:

1. tailored to meet your specific needs,

2. case studies from latest China Market deals, and

3. foundation curriculum design of core modules.

Next step:

contact us to arrange a SWOT assessment.